- 828-799-7826

- 1855 Tucker Street Hickory, NC 28601

Take Control of Your

IRS and North Carolina Tax Issues Before it’s Too Late!

828-799-7826

Shanon Stanbury

MBA, EA President & Tax Expert

We Understand What You’re Going Through!

Can’t Keep Up with IRS Tax Problems?

Taxes are a part of life, but sometimes things spiral out of control—whether it’s unpaid taxes or letters piling up from the IRS. Let StanLee Tax Resolutions step in. We’ll figure out what’s going wrong and take over the communication to stop garnishments and protect your property.

Tax Debt is too Much to Handle?

Tax debt can get overwhelming fast, and the IRS isn’t going to wait around. But you’ve got options. We can help you break it down into something manageable, whether it’s a payment plan or reducing what you owe.

State Tax Issues Keeping You Up at Night?

State tax problems can be just as tricky as the IRS. Whether it’s wage garnishments or other state tax matters, we can help resolve it before it gets worse.

Worried About an Audit?

Nobody likes hearing they’re being audited. But with us by your side, you don’t have to go through it alone. We’ll handle the back-and-forth with the IRS and make sure you’re ready.

Missed Tax Returns?

Maybe you skipped a year, or even a few. The IRS doesn’t forget, and ignoring it won’t make it go away. We’ll help you catch up and get back on track, making sure those unfiled returns don’t cause more damage.

About Us

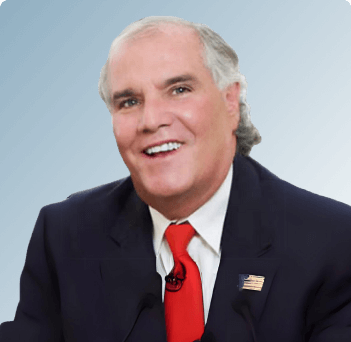

Meet Shanon Stanbury, MBA, EA

Founder & President of StanLee Tax Resolutions

With 20+ years of experience, Shanon Stanbury has dedicated her career to helping people overcome tax challenges. As an Enrolled Agent (EA) and an expert in accounting, Shanon knows how to handle even the toughest IRS and North Carolina tax issues.

A Strong Advocate for Taxpayers

Before starting StanLee Tax Resolutions, Shanon worked with countless clients facing serious tax problems. Her time in the field has given her the skills and knowledge to defend your rights and help you get back on track with the IRS.

Whether it’s unpaid taxes, unfiled returns, or an IRS audit in North Carolina (or beyond), Shanon and her team know how to resolve these problems head-on. From helping with back taxes to securing payment plans, Shanon is here to provide the support and solutions you need to fix your tax issues.

Shanon Stanbury

MBA, EA President & Tax Expert

Appeals Agent

Why Stanlee Different From Any Tax Resolution Firm.

What We Offer?

- Years of Real Experience

With 20+ years under our belt, we’ve seen it all—no tax problem is too big or small. We’re here to help you get the relief you deserve.

- Certified Enrolled Agent (EA)

Shanon’s got the credentials to back it up! As a certified Enrolled Agent, you’ll have expert guidance every step of the way.

- Full-Service, No Stress

We don’t just fix tax issues; we help you manage your finances, handle back taxes, and even offer bookkeeping so you’re all set for the future.

- Clear Communication, Always

No guesswork here! We keep you in the loop, making sure you understand what’s happening every step of the way.

What We Avoid

- No Overcomplicated Processes

We make things easy for you—no endless forms or overwhelming paperwork.

- No Hidden Fees

With us, what you see is what you get. No surprises, just straightforward pricing.

- No Unnecessary Delays

We don’t drag things out. We act fast to resolve your tax issues and get you back on track.

- No Confusing Jargon

We keep things simple and clear so you always understand what’s happening.

We are Equipped to Tackle All Kinds of IRS Tax Problems

With over 20 years of experience, Shanon Stanbury leads the team with unmatched expertise in tax resolution and IRS representation. Our team has successfully helped clients through various tax challenges, ensuring peace of mind and financial relief.

Explore All Our Services at a Glance

Our Experience, Our Expertise, Your Peace of Mind

IRS Tax Representation

Our expert team represents all IRS matters, ensuring your rights are upheld and helping you achieve a positive outcome.

Tax Resolution Services

We provide actionable solutions to resolve your IRS concerns, from tax debts to other complex matters.

Tax Debt Relief

We work directly with the IRS to find reasonable debt relief options, helping you manage your obligations efficiently.

Back Taxes Help

We address past-due taxes with quick solutions, preventing additional penalties and bringing your records up to date.

Unfiled Tax Returns

Filing overdue returns can prevent further action from the IRS. We handle the entire process to bring you back into compliance.

IRS Audit Help

If you're under audit, we offer expert guidance and representation to ensure your case is handled effectively.

Offer in Compromise

We help reduce your overall tax debt by negotiating an offer in compromise, letting you settle for less than you owe.

Tax Lien

We assist in resolving tax liens, helping protect your assets and credit from further impact.

IRS & North Carolina Tax Issues (NCDOR)

We specialize in resolving tax issues specific to North Carolina, providing expert assistance with state tax matters.

NCDOR Wage Garnishment

We help stop wage garnishments by negotiating directly with the state to set up alternative payment arrangements.

NCDOR Installment Agreement

We assist in creating installment plans that suit your situation, giving you more flexibility in handling your tax liabilities.

Bookkeeping Services

Accurate financial records are the foundation of a successful business. Our bookkeeping services ensure that all of your accounts are in order, keeping you prepared for tax season and beyond.

Payroll Management

Our payroll services ensure your business remains compliant and employees are paid accurately and on time.

General Accounting

We manage your daily accounting needs, from transactions to year-end reports, ensuring everything is properly recorded.

Tax Compliance

Stay ahead of tax deadlines and requirements with our meticulous tax compliance services.

Testimonials

The Difference We Make, In Their Words

Trust the Experiences of Those We’ve Helped

The sweetest person I’ve met lately. Shannon is a straight shooter and helped me boost my confidence level just a little bit more! Amazing person and client of my company as well!

Justin Triplett

I worked with Shanon for years before she started her business. Always professional in everything she does. She’s handled my taxes for several years- would highly recommend!!

Lajeana Lovelace

Highly recommend StanLee enterprises! One stop shop for all your accountant needs!

Timmy Mosier

Excellent service on an older tax issue between states. Resolved without angst thanks to Shanon. Professional, courteous, responsive and most of all, helpful. Strongly recommended!

Boyd Austin III

Every Delay Adds to Your Tax Burden!

- Growing Interest and Penalties : Each day adds to your tax debt.

- Risk of Wage Garnishment : The IRS could claim a portion of your income.

- Threat of Asset Seizures : Your property may be at stake.

The IRS is taking action while you wait. Protect your income and assets today!

828-799-7826

How we works

Simple Steps, Real Solutions: This is How We Help You!

Consultation

STEP 1

Once we know what’s happening, we’ll dig into the details. We’ll review all the documents and paperwork, assess the situation, and make sense of all the tax problems you’re facing. We’ll break it down into plain language, so you know exactly what needs to be done.

Analysis

STEP 2

Next, we’ll prepare a plan to get things moving. Whether you’re facing back taxes, an IRS audit, or need to set up a payment plan, we’ll outline the exact steps we’ll take to get your tax issues resolved as smoothly as possible.

Blueprint

STEP 3

Next, we’ll prepare a plan to get things moving. Whether you’re facing back taxes, an IRS audit, or need to set up a payment plan, we’ll outline the exact steps we’ll take to get your tax issues resolved as smoothly as possible.

Action

STEP 4

We don’t waste time. Once the plan is set, we’ll start negotiating with the IRS or state authorities, handle the paperwork, and get things in motion. We’re here to take the heavy lifting off your shoulders and get you back on track.

Solution

STEP 5

We’ll see your case through to the end, ensuring your tax issues are fully resolved. And we won’t just stop there—we’ll help set you up with systems to avoid future tax problems and keep things running smoothly.

Our Team

The Minds That Drive StanLee Enterprises and Tax Resolutions

Shanon Stanbury

MBA, EA President,

StanLee Enterprises, LLC

Michael Sullivan

Former IRS Agent, Teaching Instructor,Fox & ABC News Contributor

Chad C. Silver

ESQ, Tax Attorney

Justin Vaillancourt

Staff Accountant

Alison gentry

Apprentice

Robert Nordlander

Former IRS Criminal Investigator

Kaylee Dula

Dynamic Social Media Coordinator

Peter Salinger

EA, Former IRS Revenue Officer & IRS Appeals Settlement Officer

When the IRS Calls, We Answer

Ignoring IRS notices won’t make them vanish. It often leads to harsher consequences. Penalties, liens, and legal action loom when tax issues are left unchecked.

But, there’s a silver lining.

StanLee Tax Resolutions can help you escape from the intimidating IRS tax problems for good. Our team decodes complex IRS regulations and guarantees compliance with both federal and state laws. What’s more, we negotiate on your behalf, aiming for swift tax resolution and minimal financial impact.

Let us handle your burden. In the meantime, you focus on regaining your peace of mind.

FAQs

What should I do if I haven’t filed taxes in years?

Ignoring unfiled taxes can lead to mounting penalties and interest. The longer you wait, the bigger the problem becomes. At StanLee Tax Resolutions, we can help you file those overdue returns, work with the IRS to reduce penalties, and get you back on track. The sooner you act, the better the outcome.

Can the IRS take my wages or property if I owe back taxes?

Yes, the IRS can garnish your wages or even place a lien on your property if back taxes are left unresolved. Before it reaches that point, StanLee Tax Resolutions can step in to negotiate on your behalf, preventing wage garnishments and protecting your assets while finding a solution that works for you.

How can I manage tax debt when I can’t afford to pay it all at once?

The IRS offers programs like payment plans or settlements, but applying can be complex. StanLee Tax Resolutions can help you explore these options, negotiate with the IRS, and set up an affordable plan that aligns with your financial situation, so you can manage your debt without overwhelming stress.

Will the IRS audit me if I don’t respond to their notices?

Ignoring IRS notices can result in audits or harsher penalties down the road. It’s important to act quickly. StanLee Tax Resolutions can respond on your behalf, ensure all documentation is in order, and reduce the risk of escalated IRS action.

Why is proper bookkeeping important for my business?

Disorganized bookkeeping can lead to missed deductions, cash flow problems, and tax penalties. With StanLee Tax Resolutions’ bookkeeping services, we ensure your financial records are accurate and up to date, helping you avoid issues with the IRS and keeping your business financially healthy.

Contact Us

StanLee Tax Resolutions offers the support and solutions you need. Our team can help you tackle even the toughest tax problems—simply reach out to get started.